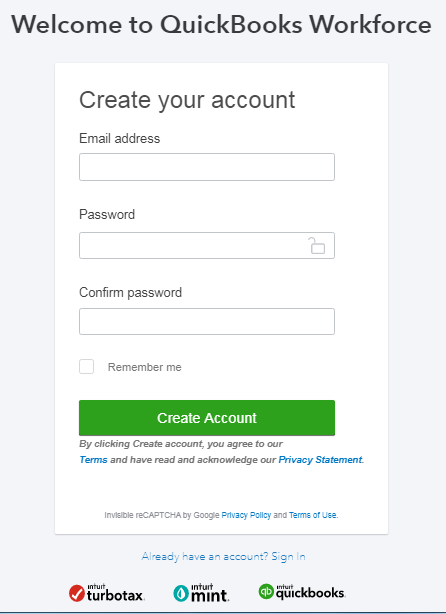

Then, add the item to the employee profile. You can add the rate and limit when you add the item to the employee profile. Leave the Default rate and limit fields blank.Under the Calculate based on quantity window, select the Calculate this item based on hours.Follow the onscreen steps based on your needs.Type in the name of the item and select Next.Choose Company Contribution, then hit Next.Click the Payroll Item dropdown, then New.Go to the Lists menu, then choose Payroll Item List.Since QuickBooks will base on the set up payroll item. On the other hand, you'll need a separate payroll items to be use on paycheck. Yes, there is a maximum of 10,000 entries for payroll items. Hi there, I'd be glad to answer your questions about setting up union contributions in QuickBooks Desktop (QBDT). I would need to add the 2023 rates and then 10 more deductions/contributions as well. There are roughly 10 deductions/contributions for 2022. I attached a screenshot of our 2022 rates, deductions and contributions. Would I need to cut two separate checks each payroll for employees that worked both new and old projects?Īny insight would be great, my CPA doesn't work with payroll or union so no help. Is there a limit to how many deductions you can enter? How do you keep the hours for the older projects separate from the newer projects and also, how will the deductions come from those hours? I am worried the total hours for everything will be deducted by both the new and old deductions and not get separated out correctly. Looking at how the 2022 deductions are setup it seems like it goes by gross pay and hours. I am newer to the company and new to union rules. At the same time you will have newer projects acquired in 2023 that will need to have the 2023 rates/deductions/contributions taken out. Per union guidelines, you can leave 2022 rates/deductions/contributions for those projects for up to 24 months. Usually we change the rates and deductions yearly, but this year we have some projects from last year that are getting wrapped up. Get a printed version (PDF) of these instructions.Does anyone have any experience with union deductions? My company hires all union employees (besides office staff) and they have a yearly set pay amount with a set list of certain deductions and contributions from the paycheck. Enter your SSN and the net pay amount from your last paycheck issued by the company and then click All Done!.If you already have one, we'll prompt you to use that account to sign up for ViewMyPaycheck. Note: If you already use an Intuit product, such as TurboTax, then you may already have an Intuit account.

You'll be asked to provide an email address, a password, and a security question and answer, in case you need to recover your password. An Intuit account allows you to access multiple sites and products with one user ID and password. We'll need this info to verify who you are and match you with the correct company and paycheck info. Make sure you have your Social Security number (SSN) handy and the net amount of your last paycheck issued by the company.Check with your employer to see if ViewMyPaycheck is available for your company.

0 kommentar(er)

0 kommentar(er)